How can we help?

Tax Season Office Hours are:

Monday to Saturday | 12 pm (noon) to 6 pm | Sunday (closed)

_______________________________

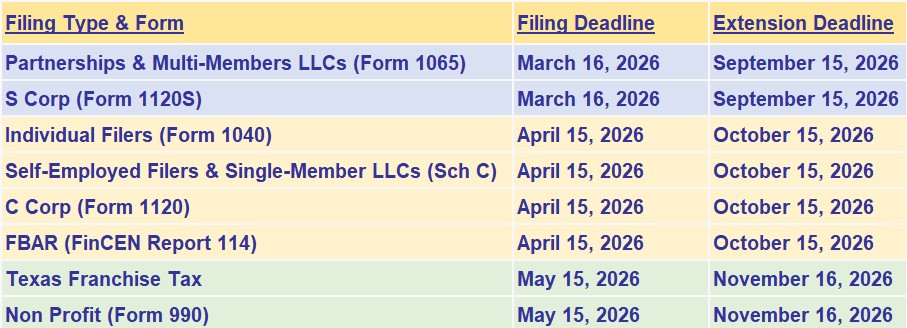

Estimated Tax & Tax Deadlines

(1) The deadline for submitting personal income tax returns and paying taxes for the tax year is usually April 15. If you need extra time to file, you can ask for an Extension, but keep in mind that it does not extend the deadline for paying any taxes owed. Failing to file and pay your taxes on time can result in penalties and interest;

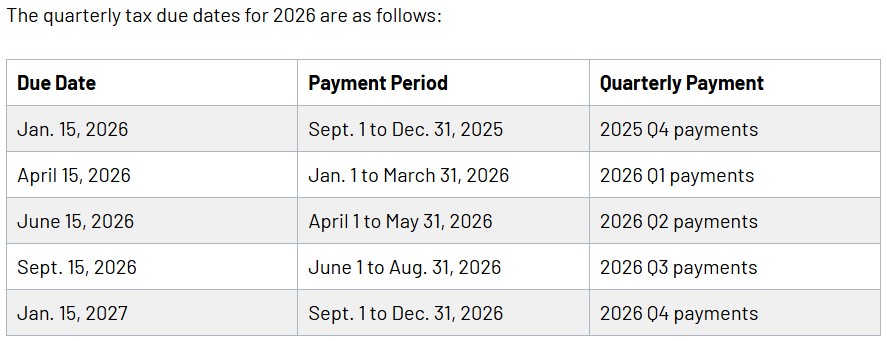

(2) For those who are high wage earners, self-employed or own a business, estimated tax payments may be required throughout the year to cover your tax liability and avoid underpayment penalties:

- If you expect to owe at least $1,000 in taxes after subtracting your withholding and refundable credits, AND

- (a) if your withholding and refundable credits are expected to be less than 90% of your current year’s tax liability, OR

- (b) 100% of the prior year’s tax liability, OR

- (c) 110% if your adjusted gross income is over $150,000;

(3) If you need to make estimated tax payments, you can use the IRS Tax Withholding Estimator to calculate and pay them at IRS Payments by January 15 for the previous tax year. For example, for the 2025 tax year, all estimated taxes must be paid by January 15, 2026 to avoid penalties and interests.

(4) The deadlines for estimated tax payments are typically:

- April 15, June 15, September 15 of the current tax year, and January 15 of the following year

- +1 972-235-2357

- +1 214-224-0820

- help@benfranklin.tax

- Monday to Saturday - 12 pm to 6 pm

- Sunday (closed)

- 1100 Business Pkwy Suite 175, Richardson, TX 75081